Income Diversification and Bank Stability in Indonesia: Does Market Volatility Matters?

Conference

64th ISI World Statistics Congress - Ottawa, Canada

Format: CPS Paper

Keywords: bank, diversification, stability, volatility

Abstract

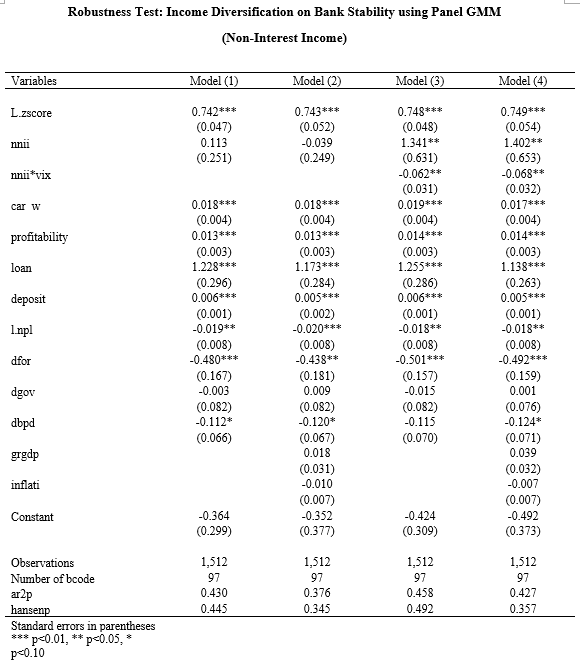

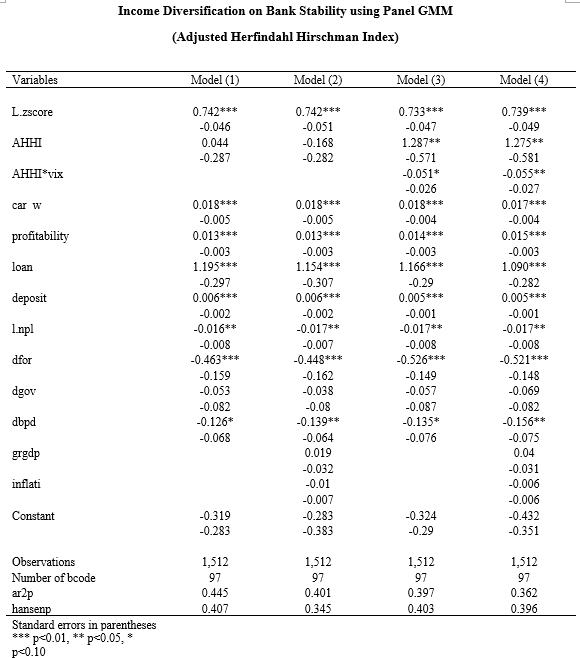

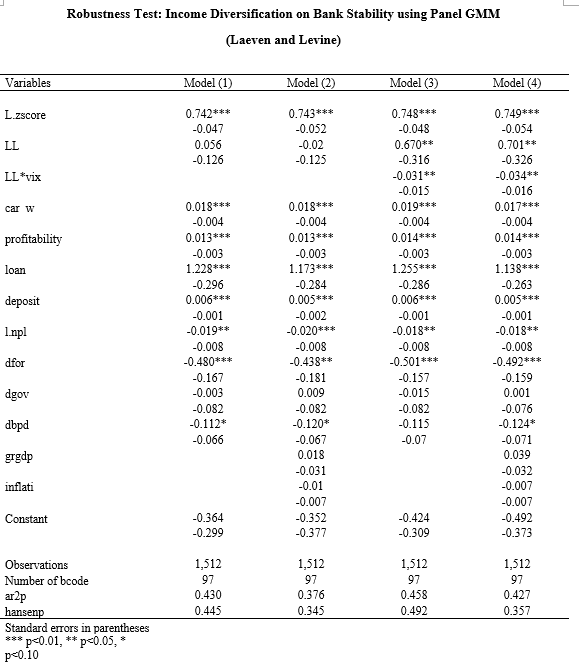

Banks are not only carrying out traditional activities but are also expanding their business into non-interest activities known as diversification. Some of the previous research showed that diversification positively affects bank stability. However, during the 2008 global financial crisis, highly diversified banks tended to collapse. Here I investigate the effect of income diversification and diversification-market volatility interactions on bank stability. The method used is a GMM dynamic panel at 97 conventional banks in Indonesia from 2001-2019. The results show that diversification has no significant effect on the stability of banks in Indonesia. On the other hand, after the model considers market volatility, income diversification is proven to have a positive and significant impact on bank stability. However, when market volatility increases, diversification has a negative and significant effect on bank stability. The results of this study imply that high market volatility in the event of a future recession will make non-interest activity conducted by banks lower financial stability and aggravate the economic condition.

Figures/Tables

Figure 1

Figure 2

Figure 3